Some services you use in life only need a quick, convenient transaction—buying gas, purchasing groceries, getting directions. But when it comes to money, you need more from your personal banking in Kansas City.

You need a relationship with your bank. What does that mean and how does it work? Read on to understand why personal banking must have personal connections.

At Cornerstone Bank, we are relationship banking, because we believe banking is 100% personal. A customer might be opening their first account, or buying their first home. They might be saving for the future, or securing a loan to cover near-term needs. The customer’s financial success is our success, and we keep their best interest in mind.

Cornerstone Bank has provided personal banking in Kansas City for over 20 years. To this day we strive to be the best for our customers. We pride ourselves on being a community bank offering concierge banking services.

Every customer is our most valuable customer, because they make it possible for us to work as a respected neighbor, and to grow as a locally owned and operated banking institution.

A relationship with Cornerstone Bank means choices.

Personal banking should cater to the customers’ needs, from how they need to spend to how they need to save.

Personal Checking

Personal checking accounts differ, and Cornerstone Bank offers a variety of checking account options. Customers can discuss their financial necessities, and choose the account that fits their lifestyle.

Personal Savings

At Cornerstone Bank, we know it isn’t always easy to save money. That’s why we offer several different personal savings accounts. Our clients can address long-term goals like college or retirement, or short-term goals such as holiday shopping or that special something they’ve finally decided to purchase.

Small Business Banking

Relationship bankers should measure success on their ability to help customers reach their goals. Transactional banks talk more about just the loans. We’ll talk about how to grow the customer’s business.

We’ll work as a partner to help that small business navigate investment decisions or operations complexities like payroll, cash flow and taxes.

Small Business Checking

Cornerstone Bank discusses the cash outflow needs of the small business, and will help the owner understand the choices for business checking accounts. We offer options for almost every size and type of business.

Commercial Loans

The Cornerstone team understands that business owners have to make tough decisions. Through the relationship we come to know and value what is at stake—the owners’ livelihoods, and that of their employees.

We treat business owners as more than a commercial loan or a loan number. For us, they’re real people and will be treated with that kind of respect and care. Do your current loan officers really know you? If they don’t, we’ll be happy to talk to you about you.

Long-distance capability

When we establish a relationship with our customers, you don’t have to “break up” with us should more business opportunities pop up outside of the community.

Many small business owners dream of opening more businesses in different locations. Should they do so, a relationship bank will already know about these goals. The small business owner can set up the inner workings beforehand, and get needed process ideation and connections to services and loans that address the business needs.

With modern mobile and online banking, backed by a banker dedicated to service, you can continue your current relationship no matter where your business grows.

Two Types of Banking

Banks function differently, depending on that bank’s goals in the community where they operate. There are two common distinctions for how banks conduct their business—as a Transactional institution, or as a Relationship institution.

Transactional Banking in Kansas City

Transactional banking (or transaction banking) focuses principally on the services and products that the institution provides, without concern about a relationship with the customer.

Transactional banking often works as a one-off experience. For example, a customer could be searching for the very best rate on a home equity line of credit. That customer might secure one with a bank wherein they have little or no other contact or interest.

Relationship Banking in Kansas City

Relationship banking provides many of these same services (if not all), but the focus is on making sure the customer feels valued. Also, an institution that performs relationship banking gets to know the customer and their financial situation, so that creative solutions can be offered to solve the customer’s problems.

By having a relationship between the customer and the bank, the customer can see their bank as a primary, reliable source for financial services and guidance.

Relationship banking works for customers on both a personal level and on a business level.

Relationship banking for personal banking

It might be odd to think of banking as a “relationship,” but a person always has a relationship with their money. Groceries, mortgage payments, vacations, future plans—all of these parts of life depend on the person’s relationship with and their connection to their money.

As a relationship bank, the institution should connect with the customer on that personal level. The bank gets to know the customer’s goals, and frequently—through customer service—the details of their personal life. A transactional relationship usually doesn’t include knowing a customer’s first name on sight, or asking about how their grandkid’s recital went.

Relationship bankers also analyze a customer’s needs and will often be proactive about offering advice and banking functions that can help the customer reach their goals or solve an issue.

This works for the bank, too. Relationship banking creates long-term goals together with the client, which can make for a life-time customer.

Relationship banking for business

Small businesses can thrive through relationship banking in Kansas City, for all of the reasons mentioned above. However, the added bonus can be improved access to business loans.

When a small business owner utilizes multiple accounts with a bank, their business becomes a known entity to the banker. The banker gets to know the small business owner’s situation, understanding the hurdles and successes for both the business and the owner.

Once established, this connection helps the bank work with the small business owner to come up with solutions and services that help that business move forward. That’s a win-win for the customer and the bank. With possible annual reviews and other services, a business owner’s relationship banker becomes a partner for success.

Other benefits of relationship banking

For personal banking in Kansas City, there are other benefits to growing together with a relationship banker.

- Networking. The bank is connected to service providers and customers who might be beneficial to your business.

- Communication. When a customer is comfortable with their banker, they can talk more openly about the financial concerns they face.

- Trust. A relationship banker bases their reputation on the trust their customers invest in them.

- Care. Relationship banking requires the bankers to care about the who and how of a customer—who they are, how they relate to their money. With this, the banker can help customers understand and use new banking services and products.

Concierge banking for personal banking in Kansas City

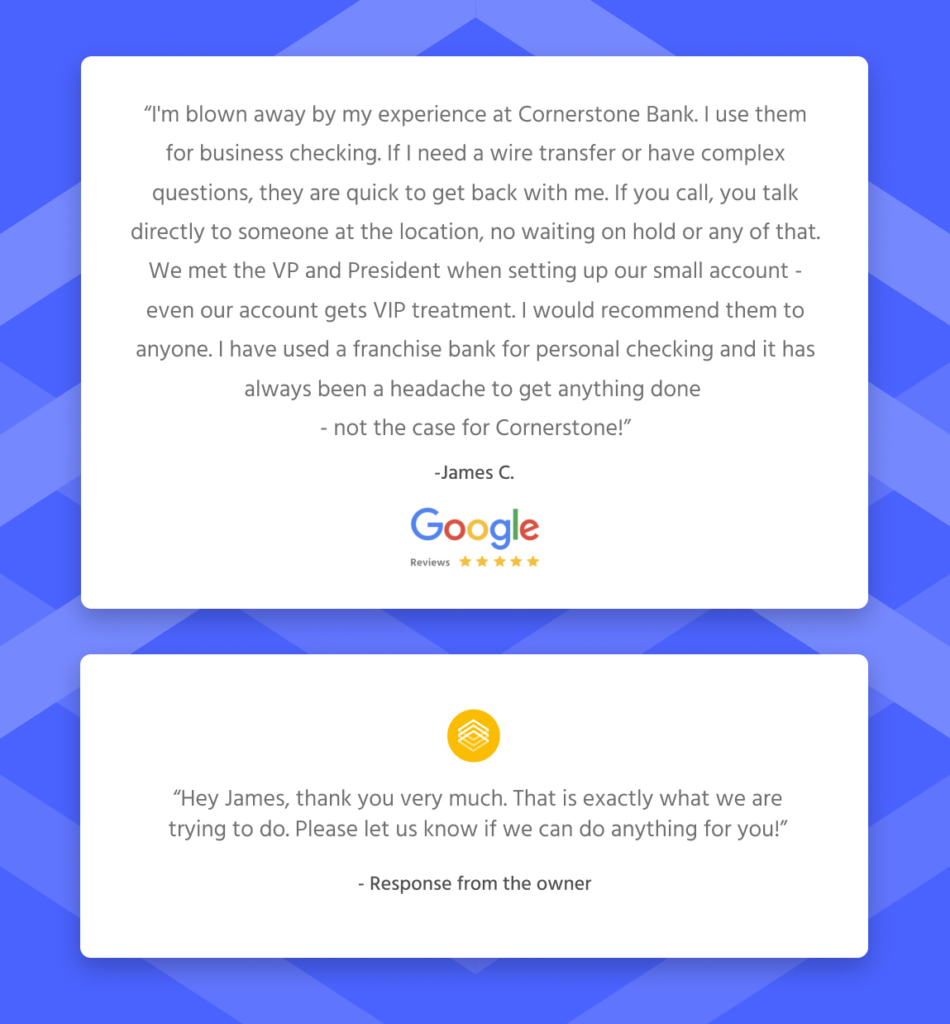

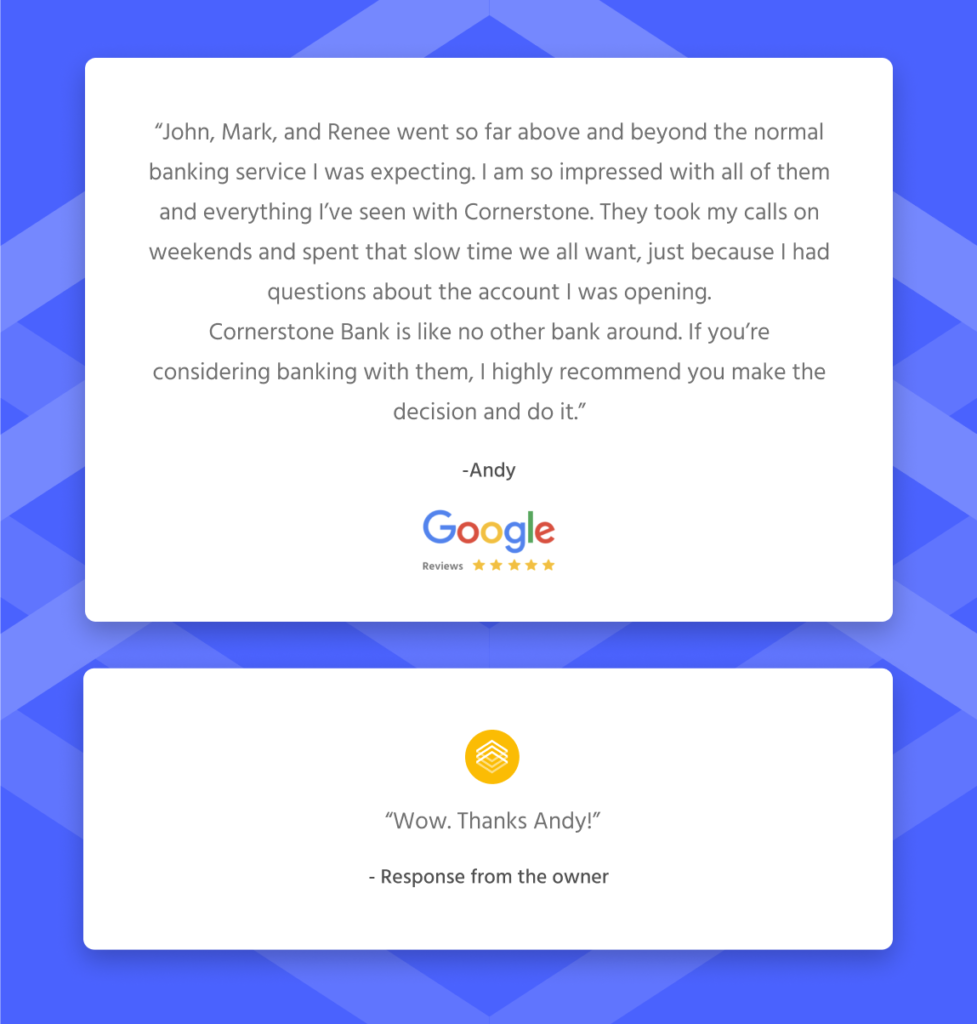

The Cornerstone Bank staff takes pride in our commitment to go above and beyond for our customers. Part of a relationship with us includes “concierge banking.”

Having been started by a small business owner, we personally know that running a business can keep you buried under work. That’s where our concierge banking can help.

For a customer’s personal life

Cornerstone Bank steps up customer service with proactive help to achieve the customer’s goals. Our staff listens, asks questions, and then seeks out any account, loan, financial information or banking solution.

In-business service.

If a business owner needs to take care of urgent documentation pertinent to their banking needs—but can’t leave work at that time for a bank visit—we’ll make every effort to accommodate a visit to them so they can keep things running at the speed of business.

Business allies and connections

Concierge banking goes above and beyond creating accounts. It means helping the business owner see the future, plan for success, and getting financial analysis and solutions that lead to growth. That’s a win for the business, for the bank, and for the community.

Find your relationship today.

Cornerstone Bank is a full service community bank serving the great Kansas City area. We proudly offer a full complement of banking services including internet and mobile banking, home equity loans, 24-hour banking and a variety of other services for you and your business. Contact us, and let’s discover what works for you.

“Serving You First” is not just our mission statement but also our daily mission. We’re not the bank on every corner. We’re Cornerstone Bank.